Have you ever stopped to think about who really decides what's on your plate? It's not just your taste buds or the local farmers market. A handful of colossal corporations increasingly dictate our food choices as they control a dominant market share of the North American food supply.

That means what you buy through choice is largely an illusion. Yes, supermarket are full of various brands, but most of these come from 10 dominant companies that collectively do over $1B of revenue daily, and because they’re publicly traded, they have a fiduciary responsibility to deliver maximum value to their shareholders.

Translation: These companies are profit making machines and are extremely adept at finding cheaper and more industrial ways to make food.

In this article, I’ll delve into the complex web of corporate control, exposing how a few powerful players are quietly reshaping the global food system to their advantage.

A Power Concentration

Our food system is no longer serving us. It’s mainly driven by power, profit and greed. Transnational corporations control our food systems through every link of the food supply chain: from seeds and fertilizers to slaughterhouses and supermarkets to cereals and beers.

Almost 80% of products in a grocery store are sold by 4 Big Food companies.

93% of the sodas we drink are owned by 3 companies

73% of all breakfast cereals are owned by 3 companies

80% of all beef processing is owned by 4 processors

Henry Kissinger once stated that those who control the food supply control the people. If we cannot grow our own food we will be forced to comply!

The size, power and profits of these mega companies have expanded thanks to political lobbying and weak regulation which enabled a wave of unchecked mergers and acquisitions. This matters because the size and influence of these mega-companies enables them to largely dictate what America’s 2 million farmers grow and how much they are paid, as well as what consumers eat and how much our groceries cost.

Dominant agribusiness conglomerates exert significant control over our food systems, leveraging their influence to sway government policies and decision-making through aggressive lobbying efforts. Their primary focus often lies in maximizing profits and appeasing shareholders, potentially at the expense of addressing critical issues like food quality and pricing.

“These changes have transformed farming from a decentralized model largely in the public arena — with local livestock auction houses and publicly-funded agricultural research — to a highly-concentrated model in the private arena — in which seeds, research, and equipment software are seen as intellectual property and guarded by dominant agribusiness firms.”

Supermarkets

Who owns your grocery store, and what entity are you investing your money in when you shop there? If it’s The Fresh Market, you're indirectly supporting Apollo Global Management, a firm with ties to the controversial Blackwater. Opting for Trader Joe's funds Aldi Nord, a German multinational grocer. And Whole Foods? That's a direct investment in Amazon and its billionaire founder.

Walmart's explosive entry into the grocery market in the late 1990s and early 2000s triggered a domino effect of mergers and acquisitions, drastically reducing the number of independent grocery chains in most regions. Once-familiar regional chains like Hannaford, Food Lion, Giant, and Stop & Shop have all been absorbed by the Dutch multinational Ahold Delhaize. Similarly, Fred Meyer, Harris Teeter, and Ralphs now fall under the Kroger umbrella, while Safeway, Shaw's, Star Market, and Vons have been consolidated into the Albertsons empire.

What about the food inside supermarkets? While the cereal aisle may appear diverse with countless brands and flavors, the majority of breakfast cereals are ultimately produced by one of only four companies: General Mills, Kellogg's, PepsiCo (through its Quaker Oats division), and Post Holdings.

Out of the 85% of groceries, these four companies control 40% of the market share. The impact of big food’s monopoly extends far beyond our food choices though, reverberating across the entire food supply chain. These days, the largest food retailers are getting into livestock and dairy markets themselves, cutting out farmers altogether. For example, in 2019, Costco opened its own, fully vertically-integrated meatpacking plant in Nebraska to produce its $4.99 rotisserie chickens. As firms grow, according to the report, they prefer to source from fewer companies in their supply chain, as this simplifies ordering, transport, and other processes.

Otherwise, the size and influence of these mega-companies enables them to largely dictate what America’s 2 million farmers grow and how much they’re paid, as well as what consumers eat and how much our groceries cost, from seeds and fertilizers to slaughterhouses and supermarkets to cereals and beers.

All this consolidation stifles consumer choice, leads to inflated prices, and loss of nutrition, while leaving shoppers with the illusion of variety and choice.

The Beef Industry

In 1980, the so-called "Big 4 Packers" held a significant but not dominant share of 36% of global beef processing. Fast forward to today, and these four multinational corporations have tightened their grip on the industry, controlling a staggering 85% of cattle processing worldwide.

Who exactly are the “big 4”? The quartet consists of Cargill, Tyson Foods (with substantial Chinese investment), JBS (a Brazilian company with a history marred by bribery and corruption scandals), and Marfrig (National Beef) another Brazilian-owned company.

Through mergers and acquisitions sanctioned by the Department of Justice, these mega-corporations have consolidated their power in the protein market, employing anti-competitive tactics to eliminate rivals and erecting barriers to entry through burdensome regulations. This monopolistic control enables them to manipulate both ends of the supply chain, depressing prices paid to cattle farmers while simultaneously inflating prices for consumers. As their profit margins soar, farmers and ranchers face economic ruin, forced out of business at an alarming rate.

Further, the meat price increases we are seeing at the moment are also the result of corporate decisions to take advantage of their market power in an uncompetitive market, to the detriment of consumers, farmers and ranchers, and our economy.

This assault on small family farms and ranches jeopardizes our nation's ability to produce its own food, transforming a once-vibrant agricultural landscape into a corporate-controlled wasteland. The loss of food independence poses a significant national security risk that cannot be ignored.

The Corporate Capture of Agriculture

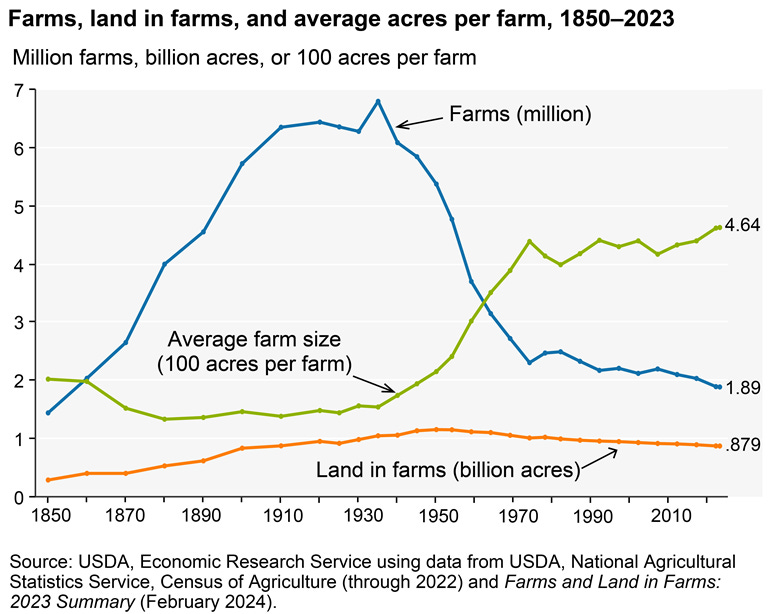

In 1937, there were nearly 6.8 million farmers in the U.S., which at that time had a population of about 100 million. Today, we have fewer than 2 million farmers, with a population of more than 325 million. What's worse, an estimated two-thirds of the farm commodities sold in the U.S. come from just 100,000 farms, and these middle-to-large-scale farms just keep getting bigger. (Source: USDA)

Now a handful of powerful multinational corporations are increasingly dominating the agricultural market, raising concerns about food security, farmer livelihoods, and consumer choice. These giants, including Bayer (formerly Monsanto), Corteva Agriscience, Syngenta Group, BASF, and ChemChina, wield immense control over various aspects of the food production chain.

The past decade, especially between 2008 and 2018, witnessed significant corporate mergers in the agrifood sector. Previously distinct areas like fertilizer production, agrochemical formulation, plant breeding, grain trading, and tractor manufacturing have consolidated under the control of a few powerful multinational corporations.

As of 2022, it’s estimated that a staggering 40% or more of the global trade in agricultural commodities is dominated by just ten giant merged corporations. These mega-mergers in agricultural commodities trading, seeds, and agrochemicals actually masks the reality that newly merged companies are largely controlled by finance and investment companies that exert significant influence over decision-making processes, including their merger and acquisition strategies.

Notably, prominent players in the financial sector, such as Blackrock, Capital Group, Fidelity, The Vanguard Group, State Street Global Advisors, and Norges Bank Investment Management, hold significant stakes in agrochemical and seeds companies, underscoring the extent of their control over the agribusiness sector and our lives.

A good example is the seed industry. Only two companies control 40% of the global commercial seed market, compared with 10 companies controlling the same proportion of the market 25 years ago, according to the ETC Group, an eco-justice organization.

Chinese companies are emerging as major players in the global agricultural market, according to a recent 141-page report by the ETC Group. State-owned Cofco has ascended to the position of the world's second-largest agricultural commodity trader, trailing only behind the U.S.-based Cargill.

Syngenta, the seed, pesticides and biotech company, is now majority owned by the Chinese government through Sinochem and ChemChina. The group controlled about a quarter of the global market in agricultural chemicals in 2020, with $15bn in sales, far greater than its nearest rivals Bayer and BASF.

There are other countries involved as major players also, with many automating through robotic technology. The Guardian.com says there is a vast digital restructuring of the commercial food system going on, including AI, robots, drones or blockchains.

This emerging paradigm of “autonomous agriculture,” is a phrase that refers to increased use of automated sensing and data technologies in farm operations. This helps to reduce dependency on human work and judgment traditionally associated with agricultural production. It also robs farmers of their decision-making capability, whether via drone-collected data, or remotely controlled tractors. Farmers are stripped of the freedom to plant traditional or other alternative seeds or apply other forms of soil fertilizers or pest control.

What’s The Solution?

The food industry has an outsized role in shaping consumer choices. According to Jack Bobo, a former U.S. government food policy advisor, many consumers are invisibly controlled by subtle external forces, from the grocery store to the dinner table, as they make decisions about what to eat

My solution is a localized approach to eating. Buy food grown very close to where you live, from farmers or ranchers that are incentivized to nourish you with real foods such as pasture-raised meat, fruits, vegetables, and eggs.

They know that if they don’t supply you with nourishing food, you will consciously choose not to buy their food. The benefits of this approach are:

You will lose weight

Have far more energy

Will truly taste & savor your food

Feel better than you ever did on a standard American diet

Your presence here is greatly appreciated and valued, so please make full use of our free library. If you've found the content interesting and useful though, please consider supporting it through a paid subscription. While all our resources are freely available, your subscription plays a vital role. It helps in covering some of our operational costs and supports the continuation of this independent, unbiased research and journalism.